Will Australia 200 Index have enough momentum to break resistance?

A Rising Wedge pattern was identified on Australia 200 Index at 7835.23, creating an expectation that it may move to the resistance line at 7871.8902. It may break through that line and continue the bullish trend or it may reverse from that line.

FTSE China A50 Index short term bullish trade setup to 12710.8799

FTSE China A50 Index is moving towards a resistance line. Because we have seen it retrace from this level in the past, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 20 days and may test it again […]

A final push possible on Hong Kong 50 Index

Hong Kong 50 Index is moving towards a line of 18589.5508 which it has tested numerous times in the past. We have seen it retrace from this position in the past, so at this stage it isn’t clear whether it will breach this price or rebound as it did before. If Hong Kong 50 Index […]

Either a rebound or a breakout imminent on Australia 200 Index

Australia 200 Index is moving towards a resistance line. Because we have seen it retrace from this line before, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 2 days and may test it again within the next […]

Breach of important price line imminent by FTSE China A50 Index

FTSE China A50 Index is heading towards a line of 12538.6602. If this movement continues, the price of FTSE China A50 Index could test 12538.6602 within the next 3 days. But don’t be so quick to trade, it has tested this line numerous times in the past, so this movement could be short-lived and end […]

Australia 200 Index approaching support of a Channel Down

Australia 200 Index is approaching the support line of a Channel Down. It has touched this line numerous times in the last 13 days. If it tests this line again, it should do so in the next 2 days.

Dramatic change in Hong Kong 50 Index. A sign of things to come?

Hong Kong 50 Index rose sharply for 4 hours – which is an excessively big movement for this instrument; exceeding the 98% of past price moves. Even if this move is a sign of a new trend in Hong Kong 50 Index there is a chance that we will witness a correction, no matter how […]

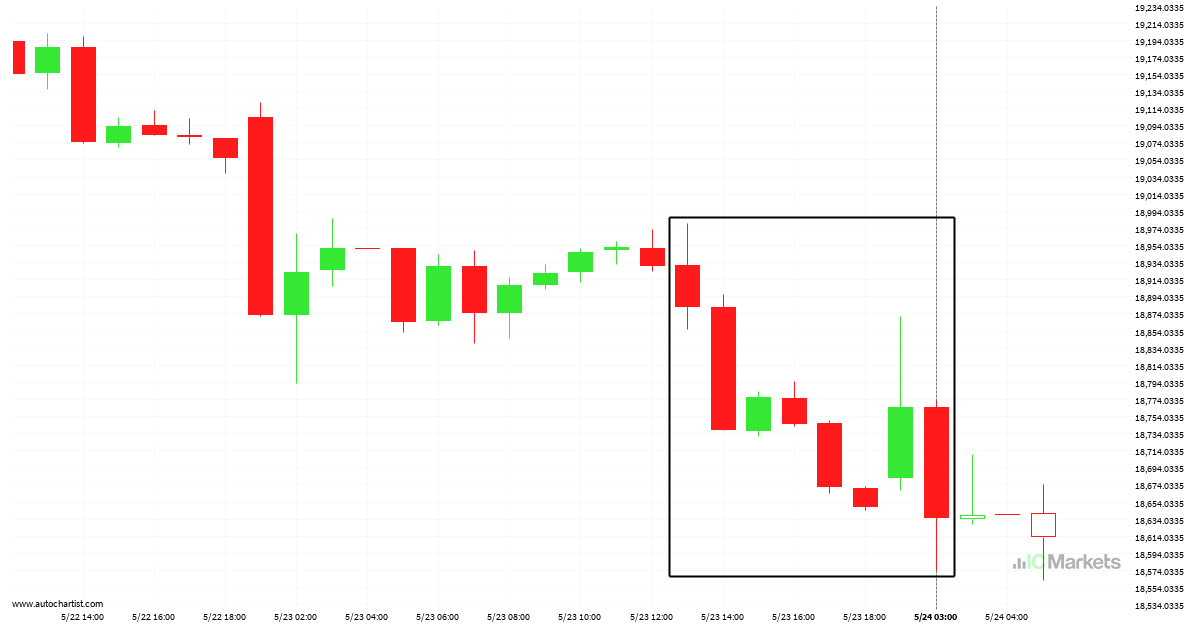

Hong Kong 50 Index is on its way down

Hong Kong 50 Index hits 18584.17 after a 2.01% move spanning 14 hours.

A final push possible on FTSE China A50 Index

FTSE China A50 Index is heading towards 12888.0498 and could reach this point within the next 13 hours. It has tested this line numerous times in the past, and this time could be no different, ending in a rebound instead of a breakout. If the breakout doesn’t happen, we could see a retracement back down […]

Either a rebound or a breakout imminent on FTSE China A50 Index

FTSE China A50 Index is heading towards the resistance line of a Rising Wedge. If this movement continues, the price of FTSE China A50 Index could test 13038.9200 within the next 2 days. It has tested this line numerous times in the past, so this movement could be short-lived and end up rebounding just like […]